THaLLE Large Language Model ด้านการเงิน

THaLLE (อ่านว่า ทะเล) คือโมเดล AI ด้านภาษาที่ถูกฝึกสอนมาให้มีความชำนาญพิเศษในเรื่องของการเงินซึ่งครอบคลุมทั้งเรื่องการเงินส่วนบุคคลไปจนถึงเรื่องของการลงทุนเบื้องต้นได้ โดยโมเดลนี้ถูกพัฒนาขึ้นโดย KBTG (KASIKORN Business—Technology Group) จากความร่วมมือของ NLP-Voice Research Lab, KBTG Labs

จุดเด่นของโมเดลนี้คือความชำนาญเฉพาะด้านการเงินที่สูงในโมเดลที่ไม่ได้มีขนาดใหญ่มากเมื่อเทียบกับ LLM ด้วยกัน เพราะว่าทุกวันนี้ LLM ที่มีความสามารถสูงและครอบคลุมหลายด้านนั้นล้วนแล้วแต่มีขนาดที่ใหญ่มากและต้องการพลังในการประมวลผลที่สูง ทำให้ต้นทุนในการจัดหา GPU และเครื่องคอมมาฝึกสอนและทำระบบนั้นสูงมาก แต่ THaLLE นั้นย่อส่วน LLM มาให้ทำเฉพาะส่วนของด้านการเงินเป็นหลักเพื่อประหยัดต้นทุนดังกล่าวโดยที่มุ่งเน้นประสิทธิภาพไปที่เรื่องการเงินการลงทุนเพียงอย่างเดียว

โดยพื้นฐานแล้วโมเดลนี้ถูก Finetuning มาจาก Qwen2-7B-Instruct ซึ่งเดิมเป็น LLM อยู่แล้วมีความสามารถพื้นฐานในการทำความเข้าใจบริบทของภาษามนุษย์และพูดคุยโต้ตอบสอบถามได้ พร้อมทั้งยังออกแบบเรื่องเทมเพลทข้อความไว้ค่อนข้างครบถ้วนแล้ว ดังนั้นหลัก ๆ ในการ Finetuning นี้คือการเพิ่มความรู้เฉพาะทางด้านการเงินให้กับโมเดล Qwen2 เป็นหลัก

ซึ่งข้อมูลที่ใช้ในการฝึกสอนและวัดประเมินผลนั้นจะเป็นชุดข้อสอบ CFA (Chartered Financial Analyst) แบบเลือกคำตอบที่ถูกต้องจากช้อยส์ที่กำหนดให้ (Multiple Choice Question Answering) ซึ่งผู้เชี่ยวชาญด้านการเงินทุกคนหากจะเรียกตัวเองว่าเป็นผู้เชี่ยวชาญได้จำเป็นจะต้องสอบผ่านใบอนุญาต CFA โดยปกติแล้วจะมีด้วยกัน 3 Level แต่ในการฝึกสอน THaLLE นี้ใช้เพียง Level 1 และ 2 เท่านั้นเพราะ Level 3 จะเป็นคำถามปลายเปิดที่จะต้องใช้มนุษย์เป็นผู้ตรวจสอบและประเมินผลอย่างมีหลักการจริง ๆ ฉะนั้นเพื่อให้สามารถวัดได้ชัดเจนจึงใช้เฉพาะชุดข้อสอบที่มีคำตอบถูกผิดชี้ชัดได้ (เพราะการทำวิจัยเราจำเป็นต้องเปรียบเทียบกับเจ้าอื่นในตลาดด้วย ดังนั้นการใช้ชุดทดสอบที่มีดุลพินิจของคนมาเกี่ยวข้องมากเกินไปอาจดูเชื่อถือไม่ได้หากไม่ใช่เจ้าของชุดข้อสอบเองจริง ๆ)

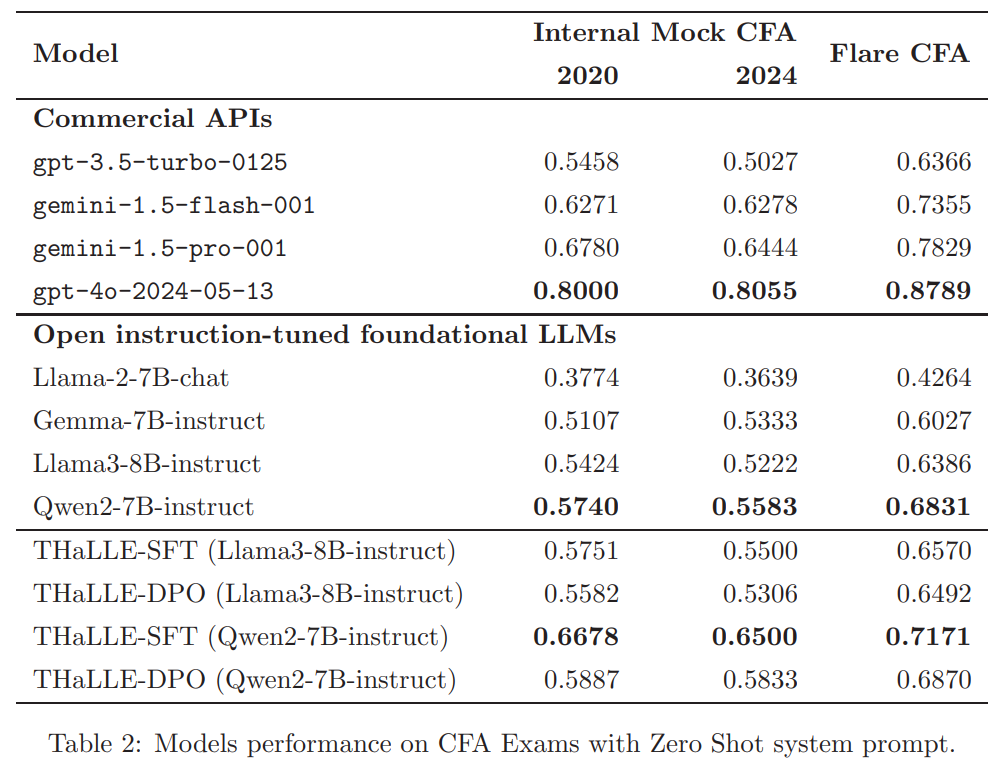

และจากการฝึกสอนและทดสอบโมเดล THaLLE ของ KBTG นั้นผลคะแนนที่ทำได้เป็นไปดังตารางนี้ ซึ่งจะเห็นได้ว่าทำคะแนนได้ดีกว่า LLM Open Source ขนาดพอ ๆ กันเป็นอย่างมาก (ดีกว่า GPT-3.5-turbo ด้วย) ถึงแม้จะยังดูห่างชั้นกับ GPT 4o ก็ตาม แต่หากเทียบในเรื่องของขนาดและต้นทุนที่ใช้ถือว่าใช้น้อยกว่า GPT 4o เป็นอย่างมาก (มาก ๆๆๆๆ)

ทั้งนี้หากต้องการอ่านข้อมูลการทดลองของ KBTG สามารถอ่านได้ที่นี่

แต่ในบทความนี้เราไม่ได้จะมาประชาสัมพันธ์แต่เพียงอย่างเดียว ในเมื่อโมเดลถูกปล่อยมาให้ลองใช้งานได้แล้วนั้นแน่นอนว่าจะต้องมีการทดสอบประสิทธิภาพกันสักหน่อยว่าจะสามารถให้คำแนะนำทั้งด้านการเงินส่วนบุคคลและการลงทุนเบื้องต้นได้อย่างไรบ้าง

Case 1: ช่วยวางแผนภาษี

User: Hello I want to do my tax planning. Do you have any advice?

Response:

Certainly! Tax planning is a crucial part of financial management, helping you to minimize your tax liabilities and maximize your after-tax income. Here are some general tips for effective tax planning: 1. **Understand Your Tax Bracket**: Knowing your current tax bracket can help you understand how much you will owe in taxes based on your income. This knowledge can guide decisions about where to allocate your income. 2. **Take Advantage of Deductions and Credits**: Be aware of all the deductions and credits that you may be eligible for. These can include mortgage interest, charitable donations, education expenses, and retirement contributions. Make sure to keep records of these expenses throughout the year. 3. **Contribute to Retirement Accounts**: Contributions to retirement accounts like 401(k)s, IRAs, or other employer-sponsored plans can reduce your taxable income. The money you contribute does not get taxed until you withdraw it in retirement, which can be at a lower tax rate than your current income tax rate. 4. **Consider Tax-Advantaged Investments**: Investing in tax-advantaged accounts such as Health Savings Accounts (HSAs, Flexible Spending Accounts (FSAs, or other employer-provided benefits can reduce your taxable income and save on healthcare costs. 5. **Plan for Capital Gains**: If you have investments, consider selling underperforming assets before the end of the year to offset gains from more successful investments. This strategy can help reduce your capital gains tax liability. 6. **Use Tax Loss Harvesting**: Selling investments at a loss can offset capital gains. This practice can help reduce your overall tax bill. 7. **Review Your Investment Strategy**: Ensure that your investment strategy aligns with your tax situation. For example, if you are in a higher tax bracket, investing in municipal bonds can provide tax-free income. 8. **Plan for Estate Taxes**: If you have significant assets, consider strategies to minimize estate taxes, such as gifting strategies or setting up trusts. 9. **Keep Good Records**: Maintain detailed records of all your financial transactions. This includes receipts, bank statements, and tax documents. Good record-keeping can help you claim all available deductions and avoid penalties. 10. **Consult with a Professional**: Consider working with a tax professional or financial advisor who can provide personalized advice based on your specific circumstances. They can help you navigate complex tax laws and identify opportunities for tax savings. 11. **Plan Ahead**: Don’t wait until the last minute to start thinking about your taxes. Early planning can help you make informed decisions and take advantage of opportunities that might not be available later in the year. 12. **Stay Informed**: Tax laws change frequently. Stay updated on changes that could affect your tax situation. This might involve reading tax publications, attending seminars, or subscribing to newsletters. By remember, the goal of tax planning is not just to pay less tax but also to ensure compliance with tax laws. Always act within the bounds of legal tax practices.

User: I have an income per year over five millions baht. And I want to reduce my tax. What should I do?

Response:

Reducing your tax liability while staying within legal and ethical boundaries is a common goal for many individuals, especially those with higher incomes. Here are some strategies you might consider: 1. **Deductions and Credits**: Make sure you claim all applicable deductions and credits. In Thailand, this includes things like charitable donations, mortgage interest, and education expenses. The exact items that qualify can change from year to year, so it's important to consult the latest tax laws or a tax professional. 2. **Retirement Savings**: Consider contributing to a retirement savings plan. Contributions to a retirement account can be tax-deductible, reducing your taxable income. This could include a pension fund or a voluntary provident fund (VPF) if you are eligible. 3. **Health Insurance**: If you pay for health insurance, the premiums may be tax-deductible. This can help offset medical expenses and reduce your overall tax burden. 4. **Life Insurance Premiums**: If you have life insurance, the premiums paid on a policy where the proceeds are not taxable to the beneficiary (i.e., term insurance, may be deductible. 5. **Real Estate Investments**: Real estate investments can offer tax benefits in Thailand. For example, rental income from property can be offset by allowable expenses such as maintenance, repairs, and depreciation. Additionally, there are are tax exemptions for certain types of real estate investment trusts (REITs). 6. **Business Expenses**: If you operate a business, ensure you are claiming all legitimate business expenses. This can include travel, office supplies, utilities, and other costs directly related to your business operations. 7. **Tax Planning Services**: Consider hiring a tax planning service or a tax accountant who specializes in high-income individuals. They can provide personalized advice based on your specific financial situation and the current tax laws. 8. **Tax Laws and Regulations**: Stay informed about changes in Thai tax laws. Tax regulations can change, and understanding these changes can help you adjust your financial strategy accordingly. 9. **Use of Offshore Accounts**: While not without risks, using offshore accounts can sometimes help manage taxes, especially if they are used for legitimate business purposes or to diversify investments. However, this must be done legally and transparently to avoid penalties or legal issues. 10. **Legal and Ethical Considerations**: Always ensure that any tax-saving strategies you employ are comply with both Thai law and international standards. Avoid aggressive tax avoidance schemes which could lead to audits, fines, and legal complications. Remember, the effectiveness of these strategies depends on your specific circumstances, including your tax bracket, family status, and other financial details. Consulting with a tax advisor who understands Thai tax laws is highly recommended.

User: I want to buy health insurance and life insurance for tax savings. What about the types of insurance should I buy?

Response:

Choosing between health insurance, life insurance, or both depends on your specific financial situation, health status, and personal goals. Here’s a breakdown of each type of insurance and how they can impact your taxes: ### Health Insurance **Purpose:** Health insurance is designed to cover medical expenses that are not covered by your employer's plan or are exceed your out-of-pocket maximums. **Tax Benefits:** - **Employer-Sponsored Plans:** If you have an employer-sponsored health plan, the premiums may be tax-deductible if they are not reimbursable through a Health Savings Account (HSA) or Flexible Spending Account (FSA). - **Individual Plans:** Premiums for individual health insurance plans are are generally not tax-deductible unless you itemize deductions and the premiums exceed 7.5% of your adjusted gross income (AGI). **Types to Consider:** - **Individually Purchased Plans:** These are available through the Affordable Care Act marketplaces or directly from insurers. - **High Deductible Health Plans (HDHPs:** These plans offer lower monthly premiums but higher deductibles. They are often paired with HSAs, which allow you to save money on a pre-tax basis to pay for qualified medical expenses. ### Life Insurance **Purpose:** Life insurance provides a death benefit to your beneficiaries when you pass away, which can help cover funeral costs, pay off debts, and replace lost income. **Tax Benefits:** - **Premiums:** Premiums paid for life insurance are are typically not tax-deductible for the policyholder. - **Death Benefit:** The death benefit received by beneficiaries is generally tax-free. **Types to Consider:** - **Term Life Insurance:** Offers coverage for a set period at a fixed premium. It is less expensive than permanent life insurance but does not build cash value. - **Permanent Life Insurance:** Includes whole life, universal life, and variable life. These policies include a cash value component that grows tax-deferred and can be borrowed against or withdrawn (tax-free if taken as a loan. ### Choosing Between Health and Life Insurance 1. **Health Insurance First:** If you do not have access to employer-provided health insurance, consider purchasing an individual plan first. This is crucial for covering medical expenses and ensuring you have adequate coverage in case of illness or injury. 2. **Life Insurance Next:** Once your health insurance needs are met, consider life insurance. If you have dependents or significant debt, life insurance can provide peace of mind knowing that your loved ones will be financially supported after your passing. 3. **Consider Your Financial Situation:** Evaluate your current financial situation, including any existing insurance policies, your family's needs, and your future financial goals. For instance, if you are planning for retirement, you might prioritize life insurance to ensure your assets are protected. 4. **Consult a Financial Advisor:** A financial advisor can help you understand the specific benefits and tax implications of different insurance options based on your unique circumstances. ### Conclusion The decision to purchase health insurance, life insurance, or both should be based on your specific needs, financial situation, and long-term goals. Prioritize health insurance to cover potential medical expenses, and then consider life insurance to protect your family's financial security. Always consult with a financial advisor to make informed decisions that align with your overall financial strategy.

User: If I want to reduce my tax with the investment in mutual fund. How can I do this? and do you know about Thai ESG?

Response:

Investing in mutual funds can be a strategic way to manage your taxes, especially if you choose funds that align with your financial goals and tax situation. Here are some ways to potentially reduce your taxes through mutual fund investments: 1. **Tax-Loss Harvesting**: This strategy involves selling securities at a loss to offset capital gains from other investments. If you sell a mutual fund at a loss, you can use that loss to offset any capital gains you have realized during the year. If you don't have enough gains to offset, you can carry forward the loss to future years. 2. **Tax-Exempt Funds**: Consider investing in municipal bond mutual funds or exchange-traded funds (ETFs). These funds typically offer tax-exempt income, which is not subject to federal income tax, and may also be exempt from state and local taxes depending on where you live. 3. **Dividend Reinvestment Plans (DRIPs)**: Some mutual funds offer DRIPs, which allow you to reinvest dividends and capital gains distributions into additional shares of the fund. This can help defer taxes on these distributions until you sell the shares. 4. **Tax-Advantaged Accounts**: Utilize retirement accounts such as IRAs, 401(k)s, or other tax-advantaged plans. Contributions to these accounts are made with pre-tax dollars, reducing your taxable income for the year. The growth within these accounts is tax-deferred, and withdrawals are are taken during retirement are taxed as ordinary income. 5. **Taxable vs. Tax-Deferred Mutual Funds**: Be mindful of the type of mutual fund you invest in. Taxable funds pay out dividends and capital gains, which are are taxed when distributed. Tax-deferred funds, like those held in retirement accounts, do not distribute income until withdrawn. Regarding Thai ESG ( or Environmental, Social, and Governance, it refers to the criteria used to measure the sustainability and ethical impact of companies and their investments. In Thailand, ESG investing has gained popularity as investors seek to align their portfolios with values that promote environmental responsibility, social equity, and good corporate governance. Thai ESG funds typically focus on companies that demonstrate strong performance in these areas. They might avoid investments in sectors known for negative impacts, such as tobacco, fossil fuels, or weapons manufacturing, and instead favor companies that show leadership in sustainability practices, community engagement, and fair labor policies. In terms of tax implications, investing in Thai ESG funds can be advantageous because they often target companies that are are less likely to face regulatory fines, legal disputes, or reputational damage, which can lead to more stable returns over time. Additionally, some ESG-focused funds may offer tax benefits by investing in tax-exempt securities or by providing tax-efficient strategies to minimize capital gains. It's important to note that while ESG investing can offer potential tax advantages, it's crucial to consult with a financial advisor to understand how specific ESG funds fit into your overall tax strategy and investment goals.

Case 2: แลกเงินยังไงถึงจะคุ้ม

User: If I want to exchange from THB to JPY. What is the best way to exchange? And What should I concern?

Response:

Exchanging Thai Baht (THB) for Japanese Yen (JPY can be done through various methods, each with its own advantages and considerations. Here are some of the most common ways to exchange currencies: ### 1. **Bank Transfers** - **Pros:** - Often offers better exchange rates compared to other methods. - Can be convenient if you have an account with a bank that supports international transactions. - Secure and reliable method. **Cons:** - May require a minimum transaction amount. - Can take several days for the funds to clear. ### 2. **Online Currency Exchangers** - **Pros:** - Quick and easy process. - Competitive exchange rates. - Can often be done online without leaving your home. **Cons:** - Fees may apply. - Security concerns if dealing with less reputable services. ### 3. **ATMs** - **Pros:** - Immediate access to cash. - No need for a bank account or prior arrangement. **Cons:** - Higher fees compared to banks or online exchanges. - Limited availability in certain areas. ### 4. **Travel Money Services** - **Pros:** - Good exchange rates. - Physical currency available for pickup or delivery. **Cons:** - Additional fees for delivery or pickup. - Not always as competitive as online exchanges. ### 5. **Currency Exchange Kiosks at Airports** - **Pros:** - Convenient location. - Quick service. **Cons:** - Often have the worst exchange rates due to convenience charges. - Limited hours of operation. ### What to Concern When Exchanging THB to JPY #### 1. **Exchange Rates** - Always compare the current exchange rate offered by different providers. Online currency exchangers and travel money services typically offer better rates than ATMs or airport kiosks. #### 2. **Fees** - Be aware of any fees associated with the exchange, such as transaction fees, service fees, or conversion fees. These can significantly affect the final amount you receive. #### 3. **Security** - Ensure that you use reputable and secure services, especially when dealing with online exchanges or currency exchangers. Check reviews and ensure they are licensed and regulated. #### 4. **Timing** - Consider the timing of your exchange. Currency markets fluctuate, so timing can impact the amount you receive. If possible, try to exchange during times of lower volatility. #### 5. **Amount Needed** - Determine how much you need to exchange and whether it's feasible to do so through one of the methods mentioned above. Some services may have minimum or maximum limits. #### 6. **Local Currency Availability** - In Japan, it's recommended to carry some cash, especially for smaller transactions. ATMs are widely available but may not always accept foreign cards. Carrying enough cash can help avoid potential issues. By choosing the right method depends on your specific needs, such as urgency, amount required, and comfort with technology or physical transactions. Always prioritize security and consider the cost-effectiveness of the exchange method.

User: I want to get the best exchange rates for THB to JPY. How to consider about timing and depreciation?

Response:

Achieving the best exchange rates when converting Thai Baht (THB) to Japanese Yen (JPY) involves a combination of strategic timing, understanding market dynamics, and possibly using financial instruments like forward contracts or currency options. Here’s how you can approach this: ### 1. **Monitor Market Trends** - **Daily Fluctuations:** Currency markets are highly volatile and can fluctuate significantly from day to day. Keep an eye on global economic indicators, political events, and central bank policies decisions that can impact exchange rates. - **Economic Indicators:** Pay attention to key economic data releases from both Thailand and Japan, such as GDP growth, inflation rates, unemployment figures, and interest rate decisions. ### 2. **Use Technical Analysis** - Analyze charts to identify patterns and trends in the THB/JPY exchange rate. Common techniques include moving averages, Bollinger Bands, and Fibonacci retracements. - Look for support and resistance levels where the currency pair might find a floor or ceiling. ### 3. **Consider Depreciation Timing** - **Depreciation Timing:** If you expect the THB to depreciate against the JPY, it might be advantageous to convert your THB into JPY before the depreciation occurs. However, predicting currency movements is challenging and often requires sophisticated analysis. - **Forward Contracts:** Consider using forward contracts to lock in an exchange rate for a future date. This can protect you from adverse currency movements but also limits the upside if the exchange rate moves in your favor. ### 4. **Use Currency Options** - **Call Options:** If you believe the THB will strengthen against the JPY, you might buy a call option to benefit from any appreciation. - **Put Options:** If you think the THB will weaken, a put option could protect you from significant losses. ### 5. **Stay Informed** - **Financial News:** Stay updated with financial news and market commentary. Many online platforms offer real-time updates and analysis. - **Consult Financial Advisors:** Professional advice can be invaluable, especially for complex transactions involving derivatives. ### 6. **Risk Management** - **Diversify:** Don’t rely solely on one strategy. Diversify your approach by considering multiple methods to manage risk. - **Set Stop-Loss Orders:** If you’re trading directly in the market, setting stop-loss orders can limit potential losses. ### 7. **Consider Transaction Costs** - **Broker Fees:** Different brokers have different fees for currency transactions. Compare costs to ensure you’re not paying more than necessary. - **Minimum Trade Sizes:** Some brokers require minimum trade sizes, which can affect your ability to execute smaller trades efficiently. ### 8. **Educate Yourself** - **Learn About Currency Markets:** Understanding the mechanics of currency markets, including supply and demand dynamics, can help you make better-informed decisions. By combining these strategies, you can increase your chances of getting favorable exchange rates when converting THB to JPY. Remember, while these tips can help, there's always an element of risk involved in currency trading. Always consider your risk tolerance and consult with a financial advisor before making significant investments.

สุดท้ายนี้หากอยากลองใช้งาน THaLLE บ้างสามารถลองได้ที่นี่

WooCommerce – Google

Digital Business

NASA – Osiris-Rex